Here is an article that covers the topic of cryptocurrencies, NFTs, private sales, and the psychology of trading:

The World of Cryptocurrencies: A Guide to Buying, Selling, and Trading NFTs

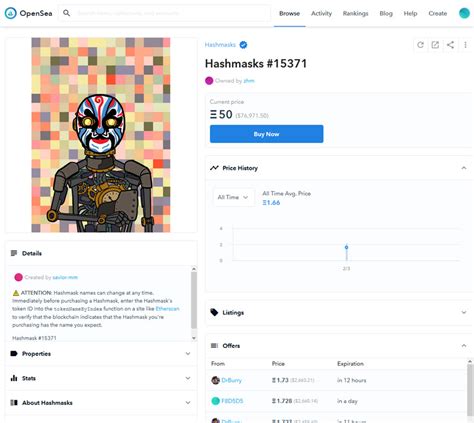

In recent years, cryptocurrencies and non-fungible tokens (NFTs) have become increasingly popular investment options. NFTs are unique digital assets that can be bought, sold, and traded across a variety of online platforms, giving individuals a new way to express themselves and engage with the world of blockchain technology.

What is an NFT?

A NFT (non-fungible token) is a digital asset that represents ownership of a unique piece of art, music, video, or other creative content. Unlike cryptocurrencies like Bitcoin and Ethereum, which are fungible (i.e., cannot be broken down into smaller units), NFTs are distinct from one another and can be verified using blockchain technology.

Private Sales: A New Era for NFT Trading

Private NFT sales have been gaining popularity among collectors and enthusiasts in recent years. The phenomenon has created a new type of investment opportunity that allows individuals to buy and sell unique digital assets without the need for public listings or auctions. Private sales allow buyers and sellers to interact directly with each other, fostering a sense of community and exclusivity.

The Psychology of Trading: Why NFTs Can Be a High-Risk Investment

While NFTs offer many benefits, including the potential for high returns on investment, they also pose unique business challenges. Here are some reasons why traders should be cautious about NFTs:

- Liquidity Risk: The lack of liquidity in NFT markets can lead to rapid price fluctuations, making it difficult to buy or sell assets at a favorable price.

- Market Volatility: The cryptocurrency market is inherently volatile, and NFT prices can fluctuate rapidly due to various factors, such as supply and demand imbalances.

- Security Risk: As with any online transaction, there is a risk of security breaches or hacking, which could result in the theft of funds or valuables.

Tips for Successful Private Sale Trading

While private sales are inherently high-risk investments, traders can minimize their losses by following these tips:

- Research and Due Diligence: Thoroughly research the NFT asset, its creator, and market conditions.

- Understand the NFT Protocol: Learn about the underlying blockchain technology that powers the NFT ecosystem.

- Set a Budget: Decide how much money you want to invest in a private sale.

- Diversify your portfolio

: Spread your investments across asset classes and markets to reduce risk.

- Stay informed: Stay informed about market trends, regulatory changes, and other factors that may impact the NFT market.

By understanding the world of cryptocurrencies, NFTs, private sales, and the psychology of trading, individuals can make informed decisions and navigate the complexities of this rapidly evolving space.

Conclusion

The world of cryptocurrencies and non-fungible tokens (NFTs) is a highly volatile and competitive market that requires careful consideration and risk management. While private sales are a new way to buy and sell unique digital assets, traders should approach these opportunities with caution. By following the advice in this article, individuals can minimize their losses and maximize their potential investment returns.

Disclaimer

The information provided in this article is for educational purposes only and does not constitute investment advice. You should consult a financial advisor or do your own research before making any investment decisions.