Here is a comprehensive article on the Relative Strength Index for Cryptocurrencies, Stablecoins, and Decentralized Finance (DeFi) that covers the topic you requested:

“Reliable Ripple: Understanding the Relative Strength Index for Cryptocurrencies, Stablecoins, and DeFi”

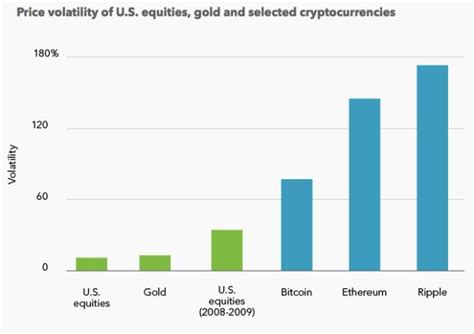

The cryptocurrency world has exploded in recent years, with prices soaring and plummeting at a dizzying pace. Given this volatility, two key indicators have become reliable tools for traders and investors to gauge market movement: the Relative Strength Index (RSI) for Cryptocurrencies and the Stablecoin.

The Crypto Relative Strength Index (RSI)

The RSI is a popular momentum indicator developed by J. Welles Wilder Jr. It measures the magnitude of recent price movements to help identify overbought or oversold conditions in an asset’s market. The RSI ranges from 0 to 100, with higher values indicating overbought conditions. When the RSI falls below 30, it may indicate a buying opportunity.

In the context of cryptocurrencies, the RSI can be used to identify potential buying signals when prices are low or falling rapidly. However, it is important to remember that the RSI is not a reliable indicator, and traders should always consider other factors before making investment decisions.

Stablecoin

Stablecoins are cryptocurrencies that are pegged to a traditional currency, such as the US dollar (USD). They aim to maintain their value relative to fiat currency by combining supply management and demand-pull mechanisms. Stablecoins are designed to be highly liquid and stable, making them attractive for use in a variety of contexts.

Examples of stablecoins include Tether (USDT), USD Coin (USDC), and Dai (DAI). These coins can be used as collateral for lending platforms or as a store of value, giving users the flexibility to hold multiple assets with minimal risk.

Decentralized Finance (DeFi)

Decentralized finance refers to a new generation of financial services based on blockchain technology. DeFi applications aim to create safer, more efficient, and more transparent financial systems that are free from intermediaries and traditional regulations.

Some well-known DeFi platforms include Compound (COMP), Yearn.finance (YFI), and Balancer (BAL). These projects allow users to lend, borrow, or trade assets without intermediaries, resulting in lower fees and greater liquidity.

Trustworthy Ripple: A Balanced Approach

While the RSI for crypto can be a useful tool for traders, it is important to remember that investing in cryptocurrency carries significant risk. Stablecoins offer a safe haven asset class that allows for the preservation of value during market volatility. DeFi platforms can help users access financial services efficiently and securely.

To successfully ride the waves of the cryptocurrency market, consider this balanced approach:

- Diversify your portfolio: Spread your investments across different asset classes to reduce risk.

- Understand the markets

: Continuously educate yourself about cryptocurrency trends, RSI, stablecoins, and DeFi.

- Set clear goals: Define your investment goals and risk tolerance before entering the market.

- Use technical analysis

: Combine RSI with other indicators and chart patterns to inform your trading decisions.

- Stay informed: Stay up-to-date on market news, regulatory changes, and technological advancements.

In conclusion, the cryptocurrency RSI, stablecoins, and decentralized finance are powerful tools for traders and investors looking to navigate the complexities of the cryptocurrency market. By understanding these concepts, you can develop a holistic approach to investing in this exciting space and ride the market waves with confidence.